Navigating the world of insurance claims can often feel overwhelming and frustratingly slow, especially when you’re dealing with the aftermath of an unexpected event like a car accident or property damage. Understandably, one of the most common questions policyholders have after such an event is, “how long does an insurance company have to investigate a claim?”

Fortunately, insurance companies are generally required by law to handle claims within a reasonable timeframe. Understanding the insurance claim process will help you manage your expectations and take appropriate steps to ensure a timely resolution.

Today, we’ll explore the typical time frame for insurance claim investigations, the factors that might affect these timelines, and what you can do if your claim seems to be dragging on.

Contents

The Standard Timeframe for Insurance Investigations

When you file a claim, insurance companies are bound by laws that dictate how quickly they must respond and conduct their investigation.

While the exact rules vary, most states require insurers to handle claims within a “reasonable” period — typically around 30 days from the date the claim is filed.

State Regulations on Investigation Timelines

- In many states, insurance companies must acknowledge receipt of a claim within a few days (typically 10 to 15 days).

- After acknowledging the claim, insurers generally have 30 days to investigate, accept, or reject the claim.

- If the insurance company’s investigation cannot be completed within 30 days, insurers may be allowed extensions, but they are usually required to provide written updates to the claimant explaining the delay.

For example:

- In California, insurers must either approve or deny a claim within 40 days of receiving proof of loss but must send status updates every 30 days if more time is needed.

- In Texas, insurers must accept or reject a claim within 15 days after receiving all required information, with extensions up to 45 days in certain situations.

These regulations are in place to protect consumers and prevent unnecessary delays in the claims process. If an insurance company exceeds these timeframes without a valid reason, they may be in violation of state law, which could open the door for legal action.

Factors Affecting the Duration of an Investigation

Several factors can influence how long an insurance company takes to investigate a claim, including:

The Type of Claim

The nature of your claim significantly impacts how long the investigation takes:

- Auto Accidents: These often involve police reports, witness statements, and repair estimates, which can take time to gather.

- Personal Injury: Claims involving medical evaluations or ongoing treatments may require additional documentation, such as medical expenses and records.

- Property Damage: Adjusters may need to inspect the damage in person, especially for high-value claims.

Complexity of the Case

Some claims are more straightforward than others:

- Clear Liability: The investigation may wrap up quickly if the fault is obvious and uncontested.

- Disputed Liability: If there is disagreement about who is at fault, the insurer may take longer to gather evidence, interview witnesses, or consult experts.

- High-Value Claims: For larger payouts, insurers may conduct more thorough investigations to ensure accuracy and prevent fraud.

Cooperation from All Parties

The speed of the investigation often depends on how quickly everyone involved provides the necessary information:

- Claimant Cooperation: Delays submitting required documents, such as medical records or receipts, can slow the process.

- Third Parties: Witnesses, repair shops, and healthcare providers may also take time to respond to requests for information.

Insurance Company Workload

During periods of high demand — such as after a natural disaster — insurance companies may experience backlogs that can slow down investigations.

Suspicions of Fraud

If the insurer suspects fraud, they may take additional time to verify the claim’s validity. This could involve interviews, surveillance, or consulting specialized investigators.

What to Do If Your Investigation Is Taking Too Long

Delays in the claims process can be frustrating, especially when you’re counting on a timely resolution to cover medical bills, property repairs, or lost wages.

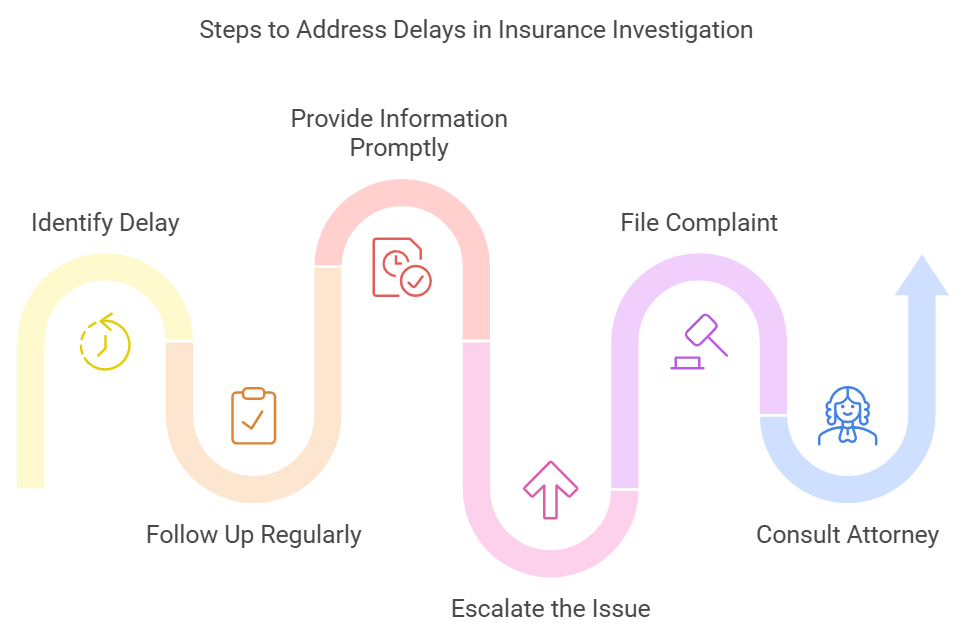

If you feel the investigation is dragging on unnecessarily, here are steps you can take to protect your interests and move the process along.

1. Follow Up Regularly

Stay proactive by checking in with the insurance adjuster assigned to your claim:

- Politely ask for updates on the status of the investigation.

- Request a timeline for the next steps or an explanation for any delays.

- Keep records of all communication, including dates, times, and the details of the conversations.

Provide Requested Information Promptly

Insurance companies often require documentation to process claims. Common requests include:

- Medical records and bills (for injury claims).

- Repair estimates or receipts (for property damage claims).

- Police or incident reports.

Ensure you’ve submitted all required paperwork and promptly respond to any additional requests. Missing or incomplete documentation is one of the most common reasons for delays.

3. Escalate the Issue

If regular follow-ups don’t yield results, you can:

- Request a Written Explanation: Ask the insurer to provide a written explanation of the delay and an updated timeline for resolving the claim.

- Contact a Supervisor: If your adjuster is unresponsive, escalate the matter to their supervisor or another higher-level representative.

4. File a Complaint with the State Insurance Department

Every state has a regulatory agency overseeing insurance practices. If you suspect the insurer is acting in bad faith or violating state laws, file a formal complaint with your state’s Department of Insurance.

5. Consult with an Attorney

If delays persist or you believe the insurer is intentionally stalling, consult a personal injury attorney so they can:

- Evaluate whether the delay constitutes bad faith.

- Communicate with the insurance company on your behalf.

- Advise you on potential legal recourse, including filing a lawsuit if necessary.

Dealing with an insurance claim can be complex and sometimes frustrating. Still, with a proper grasp of the typical timelines and factors that can influence an investigation, you can navigate the process more effectively.

Understanding the procedures, state-specific regulations, and your rights as an insurance policyholder, will help you set realistic expectations so you can take proactive steps to ensure a smoother claims experience.

For more tips and information on navigating various legal situations, read more on LegalTips.org. Here, you will find all the information you need to navigate various legal situations and protect your rights in an ever-complex legal landscape.